Blog

Nov 28 2025

Black Week Insights 2025

Black Friday is here, the busiest day of the year for e-commerce! In this overview, we explore shopping behaviour, timing, device usage, and key trends that have shaped Black Week so far in 2025.

It’s no secret that Black Friday has evolved into a much longer shopping period across brands and markets. This year was no exception. More brands, including several larger retailers, launch not only smaller early promotions, but full-scale sales already at the beginning of November.

This extended build-up has clearly shaped how consumers approached Black Week 2025, with traffic and sales being more evenly spread out in November.

In the sections below, we are sharing some insights regarding shopping behaviour across markets from an Adtraction perspective. The data used for the article comes from more than 1 700 e-commerce programs across Adtraction’s 12 European markets, covering Monday to Thursday.

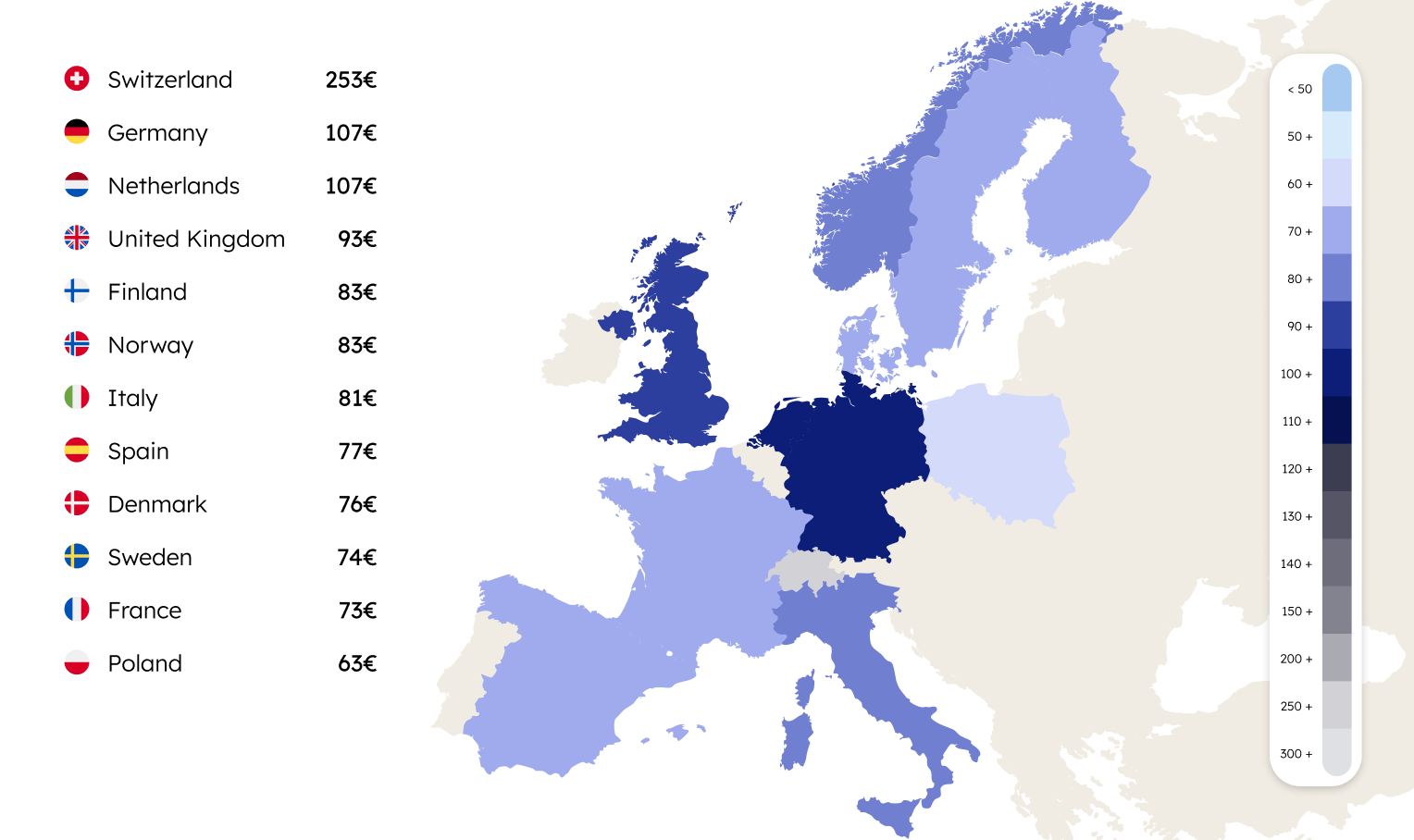

Which market sees the highest spend per order?

To get a clearer picture, we’ve analysed AOV across all our e-commerce programs for November so far. Below is an overview of how the markets compare when it comes to average order value.

Even though category mix varies between markets and influences AOV, the overall trend remains consistent and meaningful.

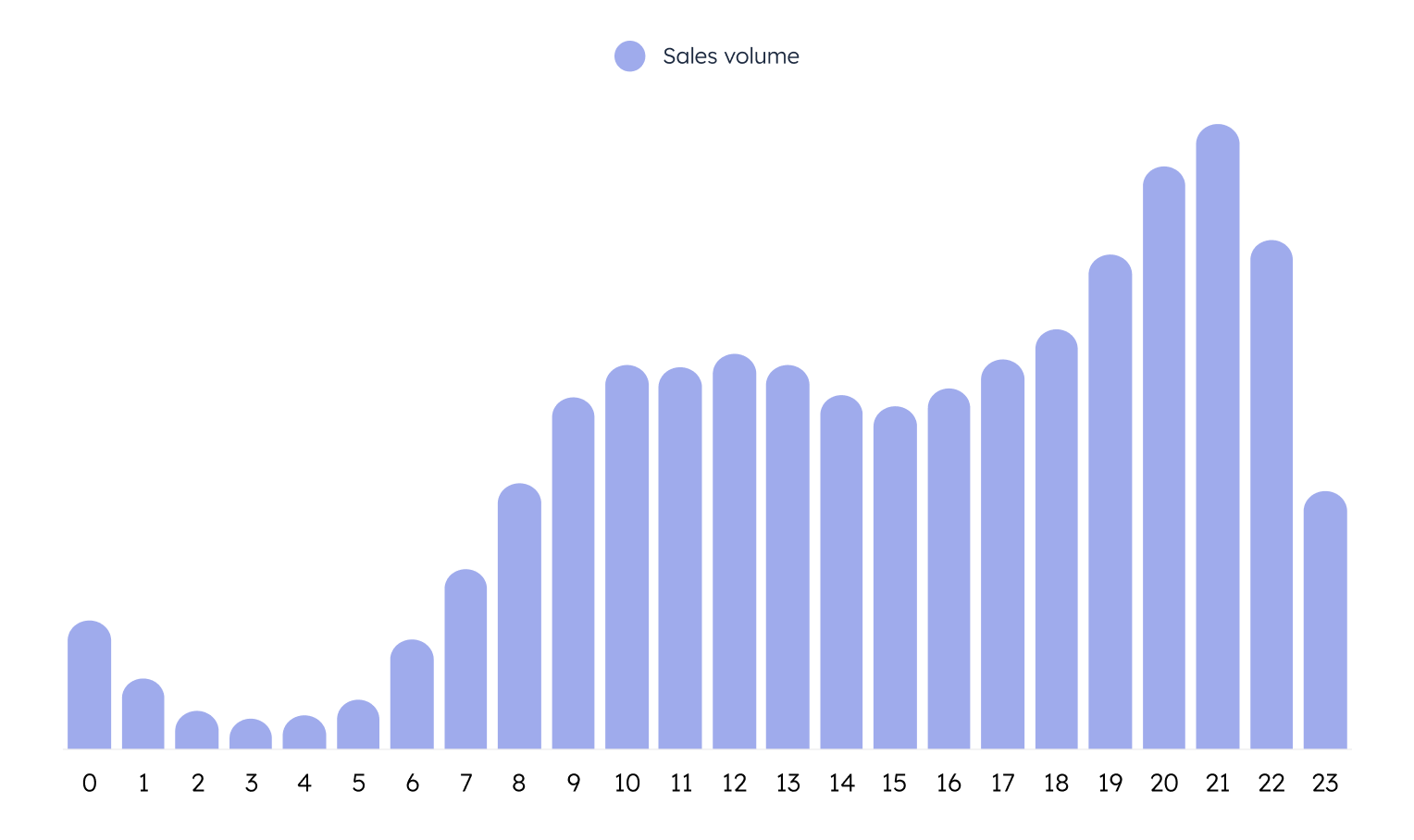

When during the day do people shop?

Shopping activity increases steadily throughout the morning before settling into a more even rhythm in the middle of the day. The strongest increase comes in the evening, when shoppers shift from browsing to completing their purchases, with a clear peak around 21:00.

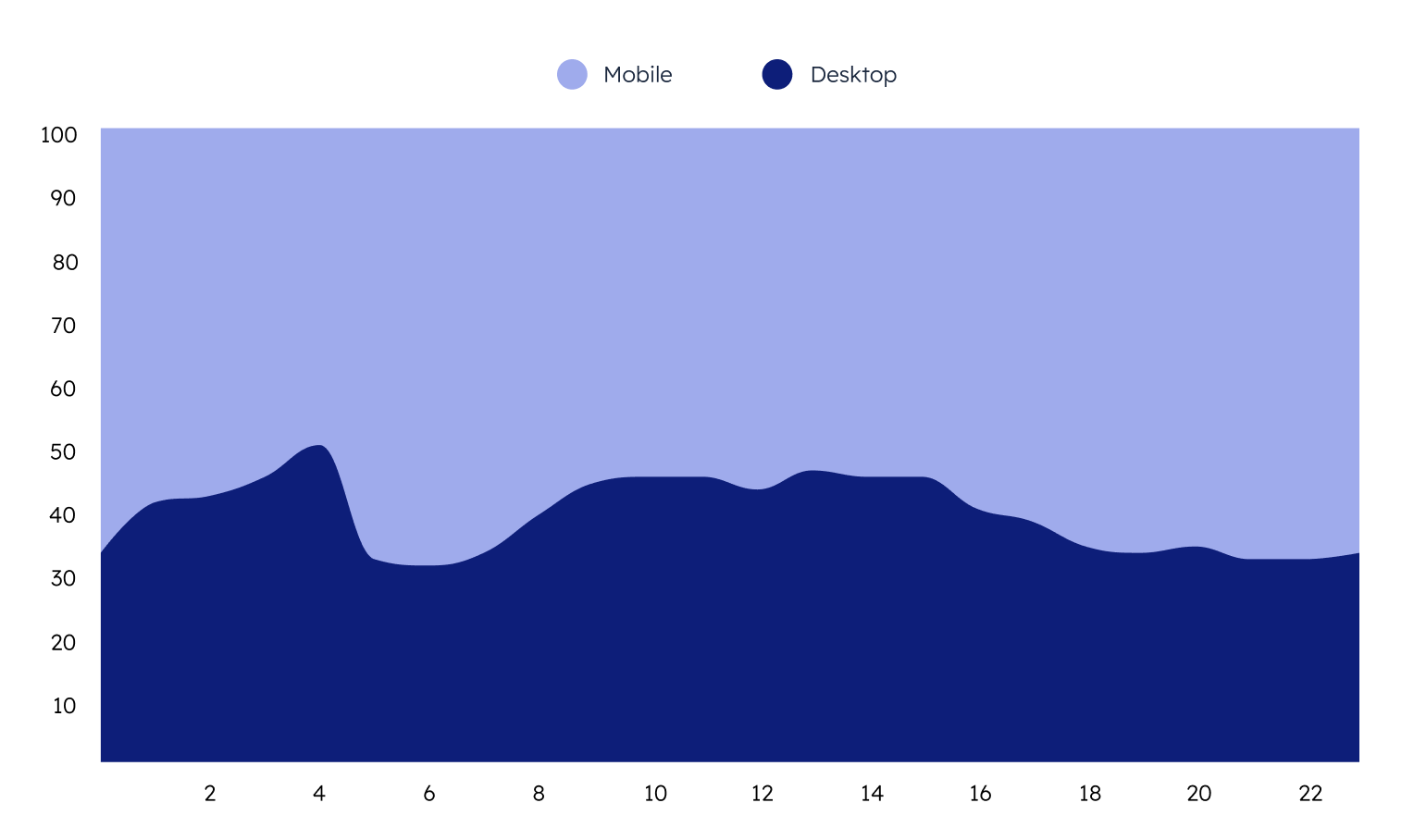

Which device do people prefer for shopping?

Reviewing the device distribution, mobile is still the dominant device during Black Week, driving most of the traffic and sales, especially in the evening hours when fewer people are at their desktops.

While mobile shopping clearly peaks in the evening, desktop remains more stable throughout the day. This suggests that although mobile leads the way, desktop still plays an important role for browsing, comparing options, and completing certain purchases.

The data highlights the need to stay focused on mobile, while also ensuring a smooth experience across devices. Shoppers switch between mobile and desktop, so it should be easy to browse and buy wherever they choose to start.

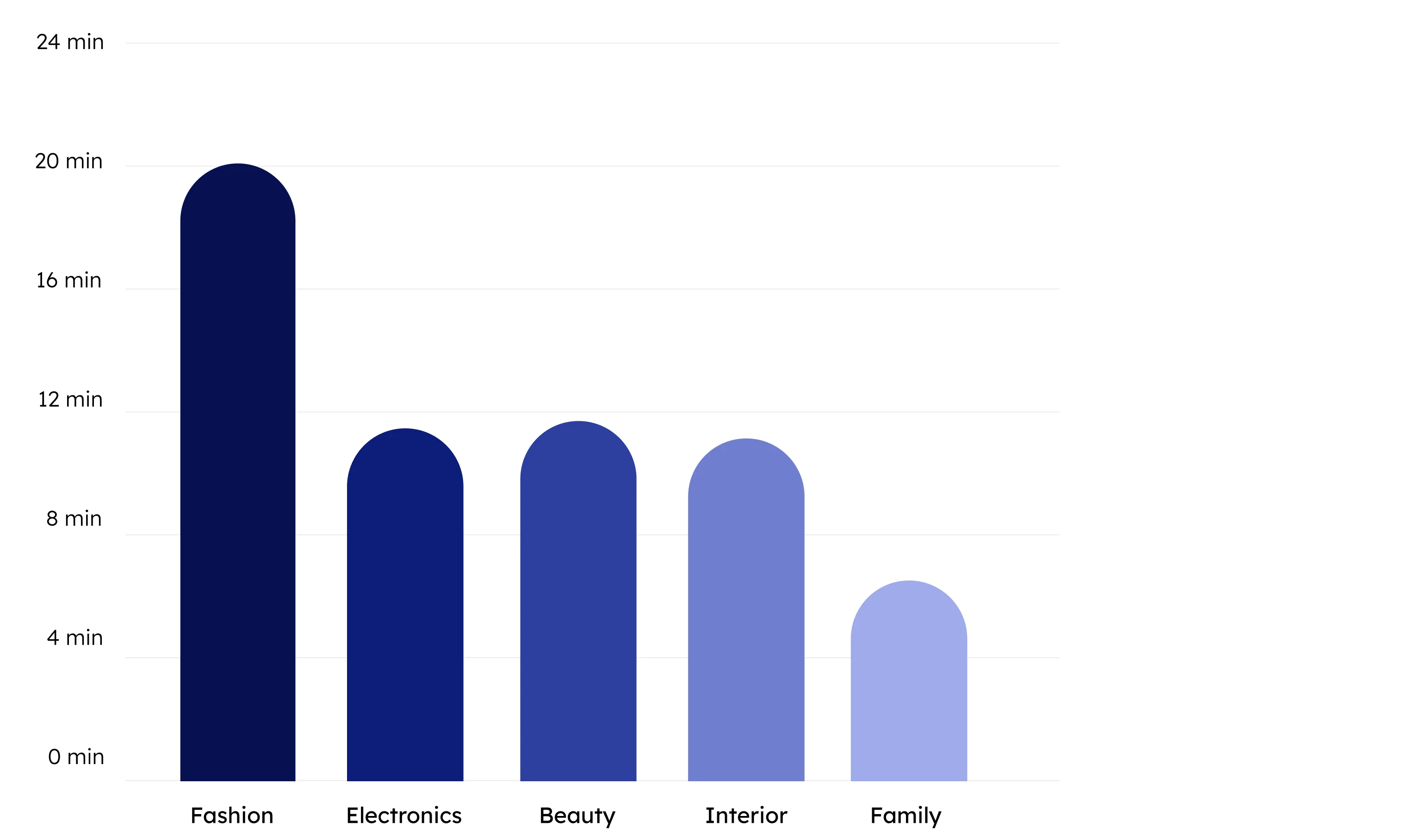

Do we shop all products at the same pace?

To find out, we reviewed our data to see whether consumers move equally quickly across different e-commerce categories. The short answer is no.

When looking at median click-to-conversion time, fashion stands out with noticeably longer decision periods. Electronics, beauty and interior follow with fairly similar timelines, while Kids & Family shows the fastest path from click to purchase.

Overall, shopping speed seems to differ somewhat by category. Fashion tends to involve a longer consideration phase, while electronics, beauty and interior appear to follow a similar mid-range pattern. Kids & Family often shows the quickest conversions, likely reflecting more need-driven purchases, but naturally, this can vary across brands and audiences.

Black Week 2025 once again shows how consumer behaviour continues to evolve, and how brands benefit from adapting early. Even though the week isn’t over, clear patterns are already emerging, with Black Week becoming an even more widespread campaign period than earlier years, and with noticeable differences across brands, markets and categories.

We look forward to seeing how Black Friday and the rest of the week unfolds, and hope this early snapshot offers a useful perspective on the trends we’re seeing so far.