Blog

Back

Nov 11 2022

The UK State of the Industry Study 2022

It’s no secret that as we write this in November 2022 the short-term growth of digital advertising is uncertain.

This year has seen widespread economic unease combined with two of digital advertising’s biggest names, Alphabet and Meta both announce drops in ad revenue on core platforms.

Against this backdrop of economic uncertainty an overwhelming majority of advertisers are set to divert more of their ad spend to partner marketing, looking to take advantage of the channel’s unparalleled ability to reach engaged online shoppers and deliver high returns on ad spend.

Last month, the UK partner marketing industry conducted a survey of advertisers and agencies, covering everything from the channel’s value, ratings of different partner types to future investment plans for the channel. Alongside seven other companies in the affiliate industry, Adtraction was pleased to send this survey out to our UK client base in October 2022.

This year’s survey followed a previous one conducted in 2021, which highlighted how partner marketing had proved a robust and popular online advertising channel during the pandemic.

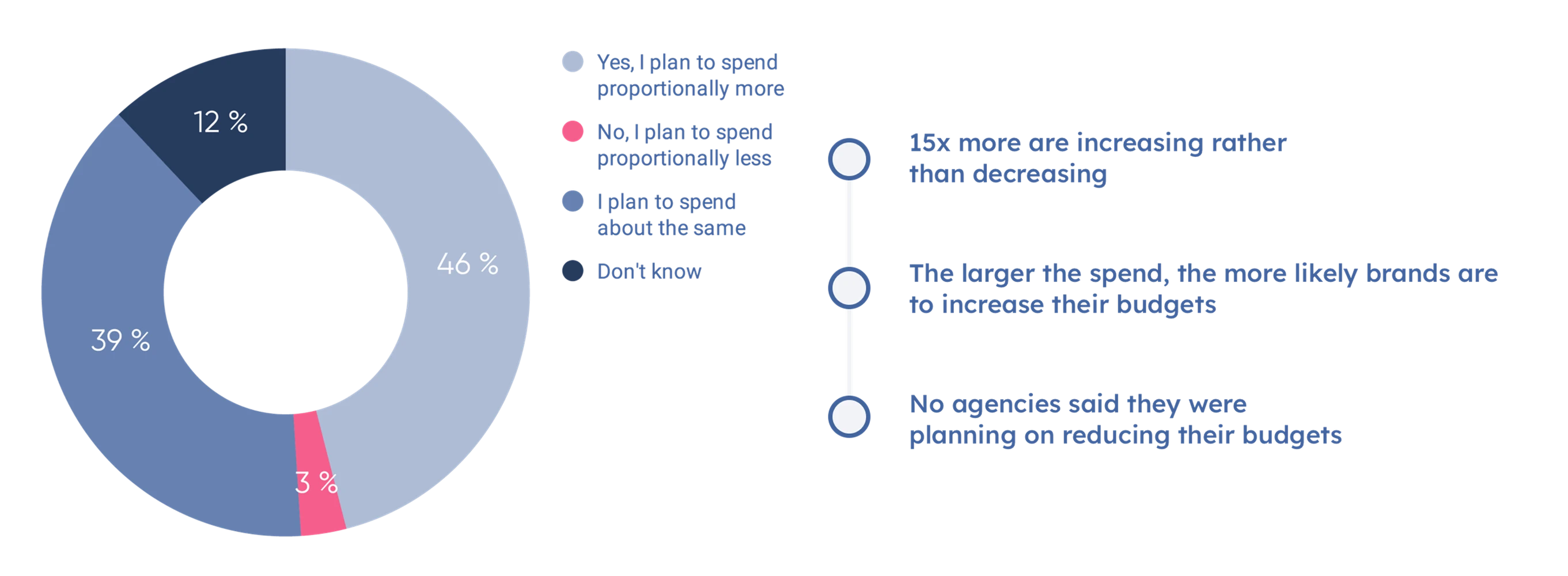

In an encouraging show of support for the channel 85% of respondents said they plan to spend the same amount or more on partner marketing in 2023, with only 3% of respondents saying they planned to spend less on partner marketing next year.

Compared to other marketing channels you use, are you looking to spend a higher proportion of your marketing budget on affiliate and partner marketing over the next year?

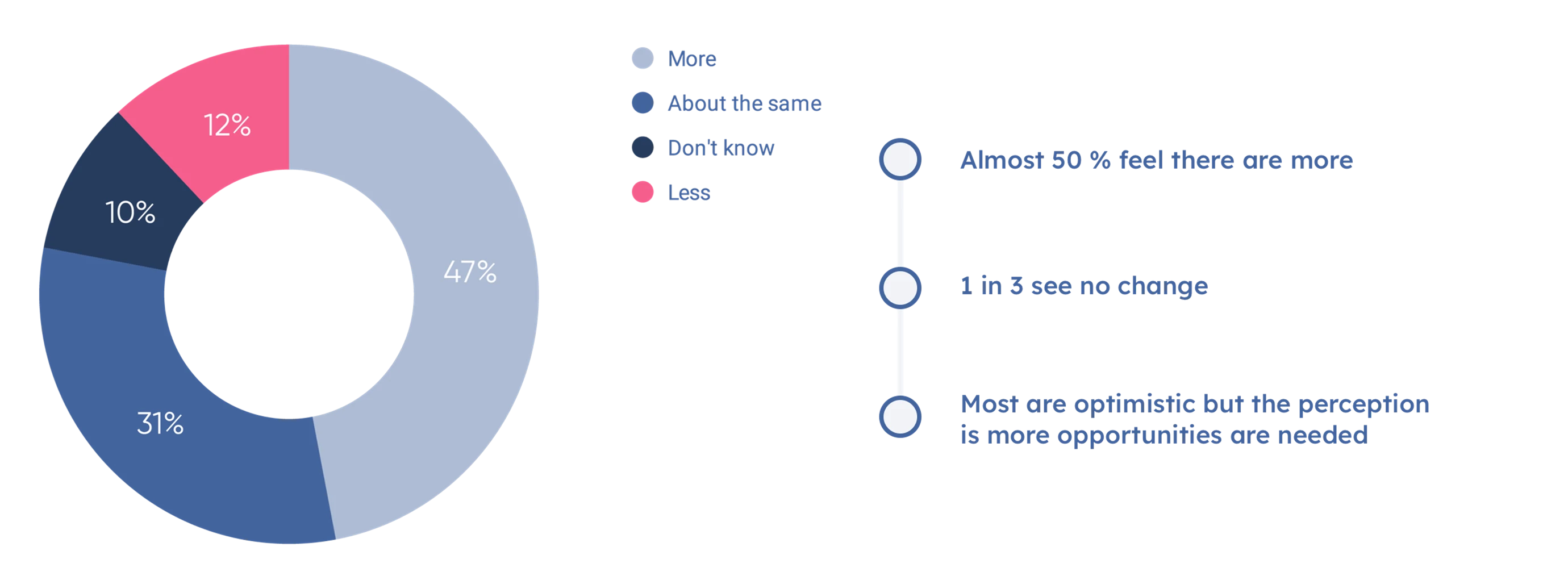

This coupled with 68% of respondents saying they felt partner marketing would be more important to delivering their marketing goals amidst the cost of living crisis suggests the flexibility and cost-effectiveness of partner marketing is going to be key to the channel’s growth in the coming year.

In light of the current concerns about the increase in the cost of living, do you think the affiliate and partner marketing channel will be more or less important in helping you to achieve your marketing goals?

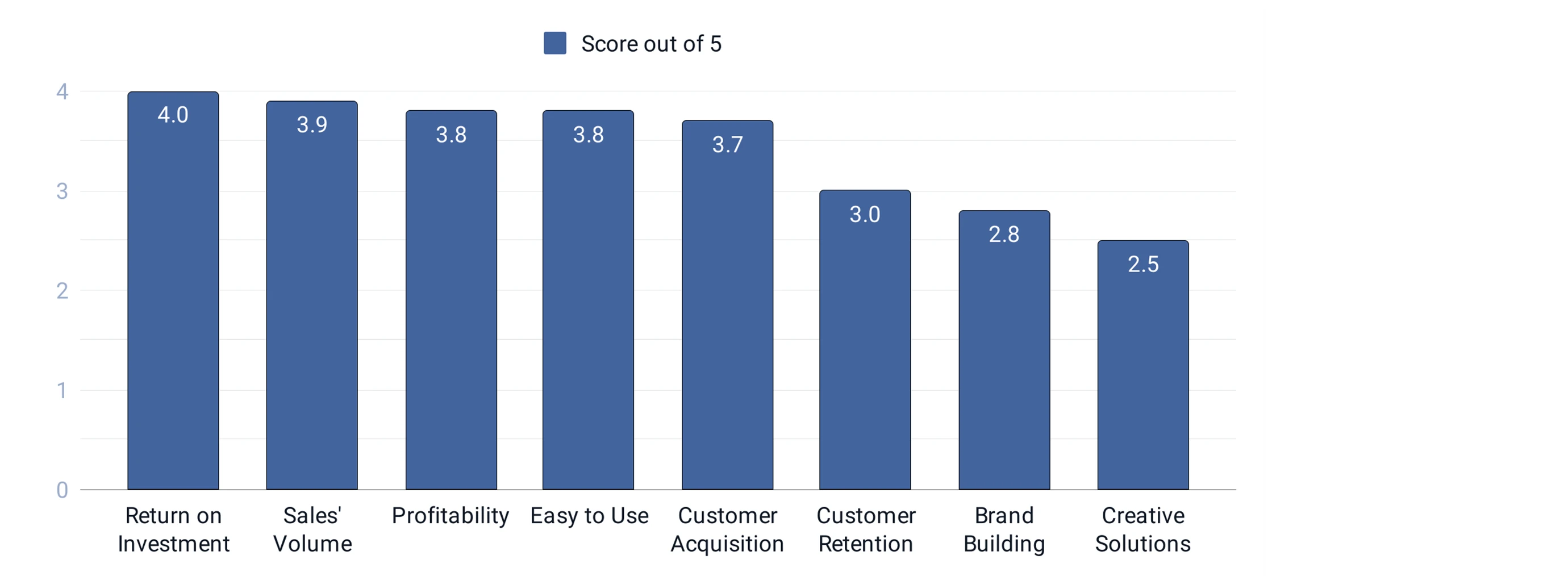

When asked to rate partner marketing’s effectiveness across a series of key metrics ranging from hard sales and cost goals to softer objectives like brand building, the results were overwhelming. ROI, Sales Volume and Profitability were the three most popular metrics, while brand building and creative solutions were the least popular.

Compared to other marketing activities, how do you rate affiliate or partner marketing for achieving the following marketing results? (Score out of 5)

While this again underlines partner marketing’s strength as a channel that drives profitable, results-driven advertising it also shows there is work for the channel to do to convince brands that it can help to build brand equity in the same way as other digital channels.

To further underline the positivity surrounding partner marketing in the eyes of advertisers and agencies, almost half of respondents felt there were more partnership opportunities available in the channel than a year ago, suggesting the channel is well-placed to help brands grow and acquire more customers in what is sure to be a challenging economic climate.

Compared to a year ago, do you think there are more or less affiliate partnership opportunities in the affiliate and partnership channel?

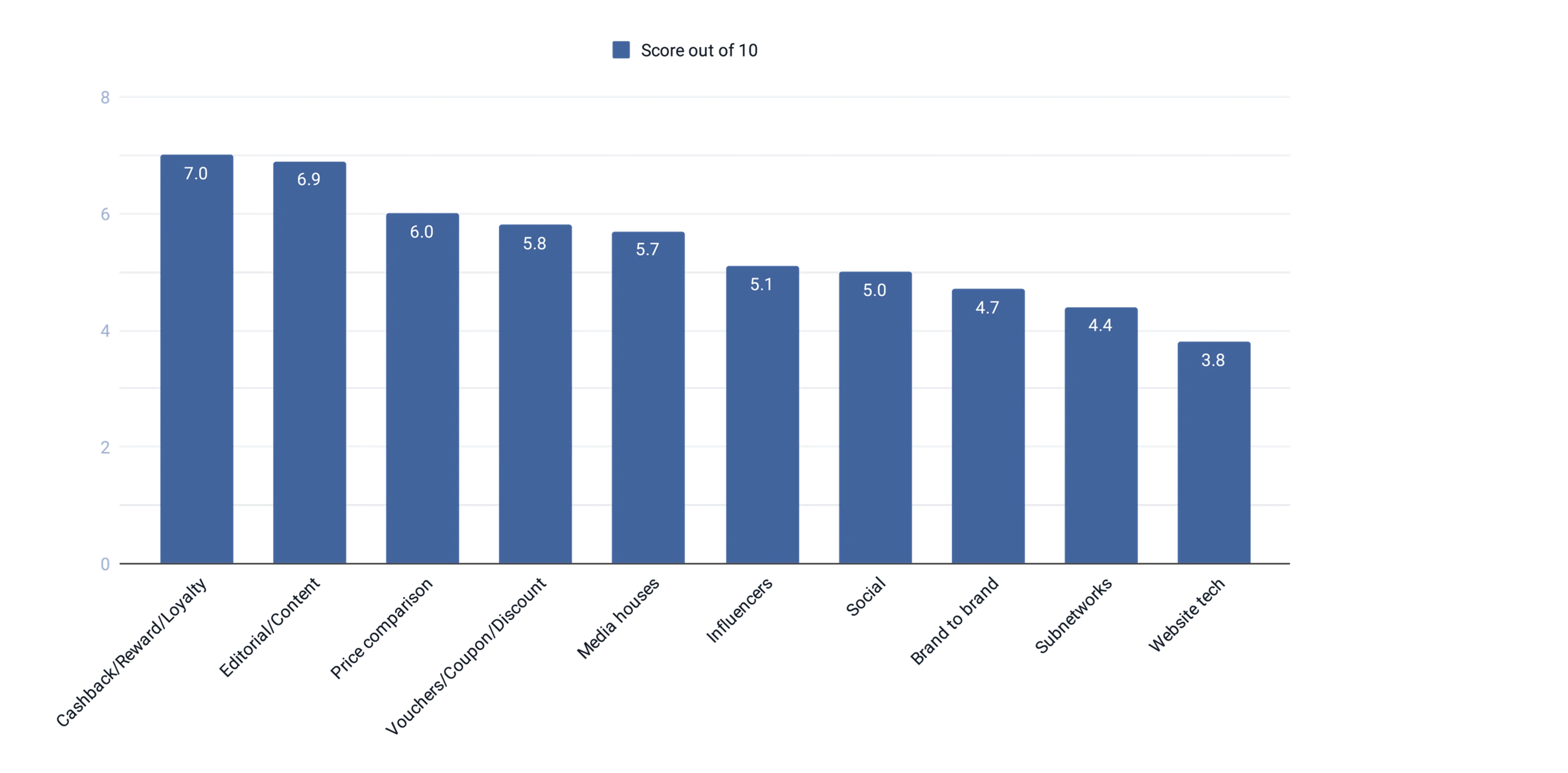

This year’s survey also asked respondents a series of questions around how they rate the value derived from different partner types across the channel. These responses need to be taken in the context that not all advertisers or agencies work with all partner types, but the most positive sentiment was directed towards the industry’s most traditional and long-standing partner types - loyalty, editorial content, price comparison and voucher codes.

On a scale of one to ten, how valuable are the following affiliate models, with ten being most valuable and one being least valuable?*

Many of the models to the right of the line are the more strategic partner types that are newer or set-up as one-to-one relationships, so it’s no surprise that support for them was more sporadic.

While social media and influencers attract a lot of interest amongst advertisers it was noteworthy to see those partner types less well rated compared to the more traditional types. This may be a symptom of these partners requiring additional fixed costs, gifting and more time to set-up.

When asked to choose 3 partner types that they want to invest more in over the coming year respondents chose editorial content as the clear winner.

Editorial content was also the second most highly valued partner type. This underlines that even though content websites are not the newest or the highest volume partner type, they retain a potent mix of customer engagement, brand awareness and sales-driving ability that make them a firm favourite with brands.

It is reassuring that in the midst of a turbulent economy partner marketing remains a highly effective and popular channel for the many brands that rely on it to drive profitable customer acquisition. There are plans to run this survey annually in the UK. It will be interesting to see how opinions on the value of the channel and the different partner types develop over the next 12 months.

The full version of State of the Industry: 2022 Advertiser & Agency Study can be downloaded here.