Blog

Jul 29 2019

What is Klarna and does it matter to affiliate marketing?

It’s virtually impossible to escape seeing Klarna at the moment. It’s definitely taking off big time in the UK ecommerce space. Every other day there’s an article or press release about a retailer who’s added Klarna as a payment option on their site. So what is it and how does it work? And importantly for us, how might the immense growth in Klarna payments impact the affiliate world?

Who is Klarna?

Klarna or Klarna Bank AB is a Swedish fintech company that has actually been around since 2005. It borders on a household name in the Nordics, with almost half of all e-commerce sales going through Klarna. Its global expansion has been impressive and it’s now considered to be one of Europe’s largest banks providing payment solutions for 60 million consumers across 130,000 merchants in 14 countries. In 2017 the company was valued at over $2.5 billion. And this growth hasn’t been curbed despite the decision to have rapper (and Klarna investor), Snoop Dogg front their "Smoooth Dogg" advertising campaign.

How does Klarna Work?

Klarna is integrated by retailers onto their site as an alternative payment option for customers. At the checkout stage customers can select Klarna and without adding any further details or credit / debit cards can complete their purchase. They aren’t taken out of the checkout process and the qualification is near instant. In fact it’s quite frightening just how quickly you can spend without it costing a penny in the moment.

Klarna then manages the payment with the customer, with three options:

- Payment 30 days after delivery

- Pay in 3 instalments, staggering a third of the payment every 30 days

- “Slice it”. This is what you might think of as the traditional credit setup, spreading the cost with interest added

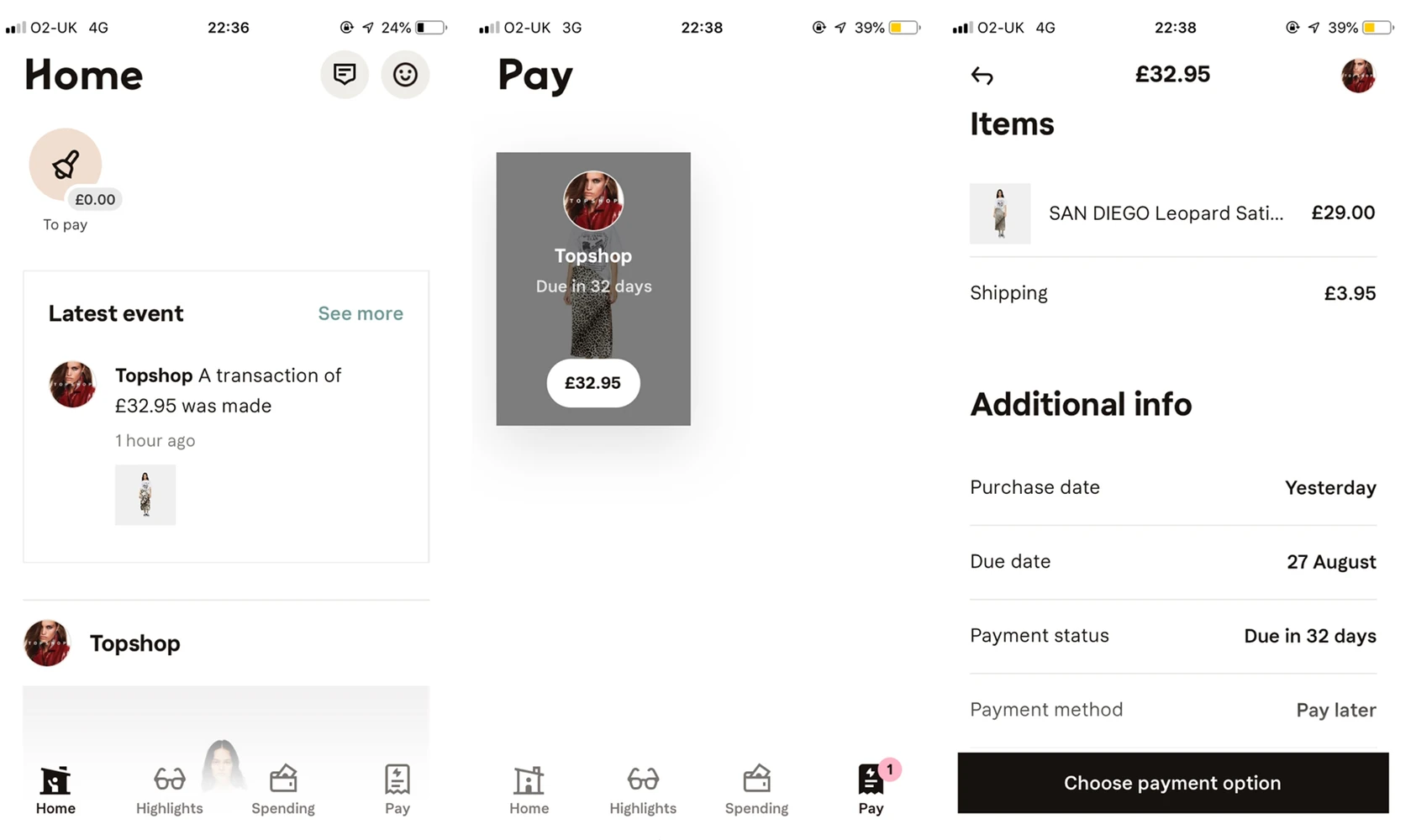

Customers can download an app and manage their payments to Klarna, which aggregates a view of all purchases made and sends reminders when payments are due.

Shop Now. Wear now. Pay Later.

Consumer Fintech seems like an unstoppable movement that’s really tapping into the changing desires of customers. And the Klarna app feels more like a fashion statement then it does a financier.

Buying from online stores with Klarna has made the checkout process even more efficient and user friendly. The idea that users can stagger their payments is gaining momentum as it removes the need to wait till payday. Klarna feels like manna from heaven for Gen Z. Where Instagram has made product and trend discovery easy, Klarna has made the instantaneous purchase effortless, no matter how far away payday is. For brands that want to capture the impulse shopper Klarna is easy and likeable.

One big bonus of managing payments on Klarna is that fact that savvy shoppers can postpone their payments to manage their returns. Klarna payments are due 30 days after an order is shipped, so customers could receive their items, try them on, decide they don’t want them and return them, all without paying. It’s the ‘try before you buy’ practice from yester-year catalogue shopping.

In the fashion sector particularly, this payment process greatly enables shoppers. Though whether this drives more sales is debatable. Perhaps more cynically, this very process could be enabling the rise of ‘snap and send back’ behaviour fuelled by social media and that ubiquitous OOTD hashtag. Infact, research by Barclaycard into this phenomenon identified that one in ten shoppers admit to buying clothes to post photos on social media and then returning them.

The Klarna impact on Affiliate Marketing

Klarna is integrated on thousands of sites who run affiliate programmes. With more users adopted every week and more retailers choosing to partner with Klarna the impact could be more than just choice of payment solution for consumers.

Let's consider what Klarna won’t change. It certainly shouldn’t cause any disruption to affiliate tracking; users aren’t taken away from the checkout page and no external party injections change the journey as the payment is integrated directly into the e-commerce site. Klarna also shouldn’t impact the attribution of affiliate-referred traffic.

Positively, the integration of Klarna could benefit affiliates. The ease of purchase could increase conversion rates, encourage more frequent returning customers and incentivise higher average order values. Perhaps in time the rise in Klarna as a B2C fintech will also see users gravitate towards retailers who offer the payment option.

And future gazing? Given how much of a focus the Klarna app has on lifestyle it’s conceivable that there could be an element of marketing over time, it already has a focus on content, with sections of the app including #shoppinghacks.

For affiliates, the payment method may also become a promotional opportunity, like free delivery has been in times before. At Adtraction we’re encouraging our advertisers to look at the data behind payment options, as a way that we can improve the optimisation of particular affiliates against all these areas; conversion, AOVs, repeat customers, return rates. It’s all part of understanding valuable customer life-time data.

How Efficiently does Affiliate Marketing Handle Validations and Customer Returns?

One area that affiliate marketing struggles with is the immovable way it treats the validation process, often waiting well past the returns period before validating and paying publishers. This is one of the major pain points for affiliates, which causes promotion stagnation and cashflow challenges, impacting the opportunity to re-invest commission quickly.

The current validation system for affiliate marketing is a solution that was created over a decade ago, and no party has really challenged or improved the practice since then. But in todays’ landscape it’s archaic and stunts channel optimisation.

Klarna payments shouldn’t negatively impact or elongate the affiliate validation process, as the advertiser receives payment from Klarna at the same time as they would have done from a user’s credit / debit card. There should no no different process of handling validations for Klarna transactions, though if you’re an affiliate it’s always best practice to keep an eye on any changes to decline rates for advertisers, just to be diligent.

Customer return behaviour is certainly a wider issue that is prompting advertisers in sectors like fast-fashion to consider how they adapt the way they handle affiliate validations. Whilst Klarna is somewhat impartial in this issue, its growing popularity amongst retailers and consumers alike does demonstrate another reason the affiliate validations process needs to be addressed.

Changing Consumer Behaviour Changes Marketing

Klarna is perhaps symbolic of the innovation and changing shopping behaviours opportune to retailers. In opposition to this is the clunky and inefficient way that affiliate validations currently occur.

Fintech companies like Klarna are disrupting the current e-commerce payment process. Customers can buy now, part-return tomorrow, and pay later. Solutions to optimise and manage purchases are currently being adopted by UK retailers at lightning speed. This is especially evident as we approach the Golden Quarter where advertisers need to maximise the peak sales period (and perhaps also to get important integrations like Klarna live before technical site changes get locked down in Q4!)

However the affiliate validation process for these retailers has remained largely the same for over a decade.

If Klarna is teaching us anything in affiliate marketing it’s that revolutionary doesn’t always mean completely new (buying on credit is definitely not new!) but it does need to be improved upon to see any amount of adoption. Affiliate marketing needs to heed that lesson when it comes to validations, ensuring the industry keeps pace with the fintech revolution.