Whitepaper

Incrementality in partner marketing

This report explores the incremental value of partner marketing across a range of brands and e-commerce categories. We have analysed close to 10 million transactions to compare the average order value (AOV) of purchases made through the partner marketing channel with those made through other channels.

The study looks at how partner marketing drives real, measurable value for brands. By comparing transactions coming from the partner marketing channel, and transactions from other digital marketing channels, we’re able to see the added value partner marketing brings.

The data shows that on average, partner marketing creates more value for brands than other digital channels. Partner marketing-driven purchases often result in higher order values, both on mobile and desktop. Overall, the findings confirm that the partner marketing channel is a valuable addition to the marketing mix, helping brands increase revenue and reach consumers wherever they choose to shop.

Key findings

Higher average order value

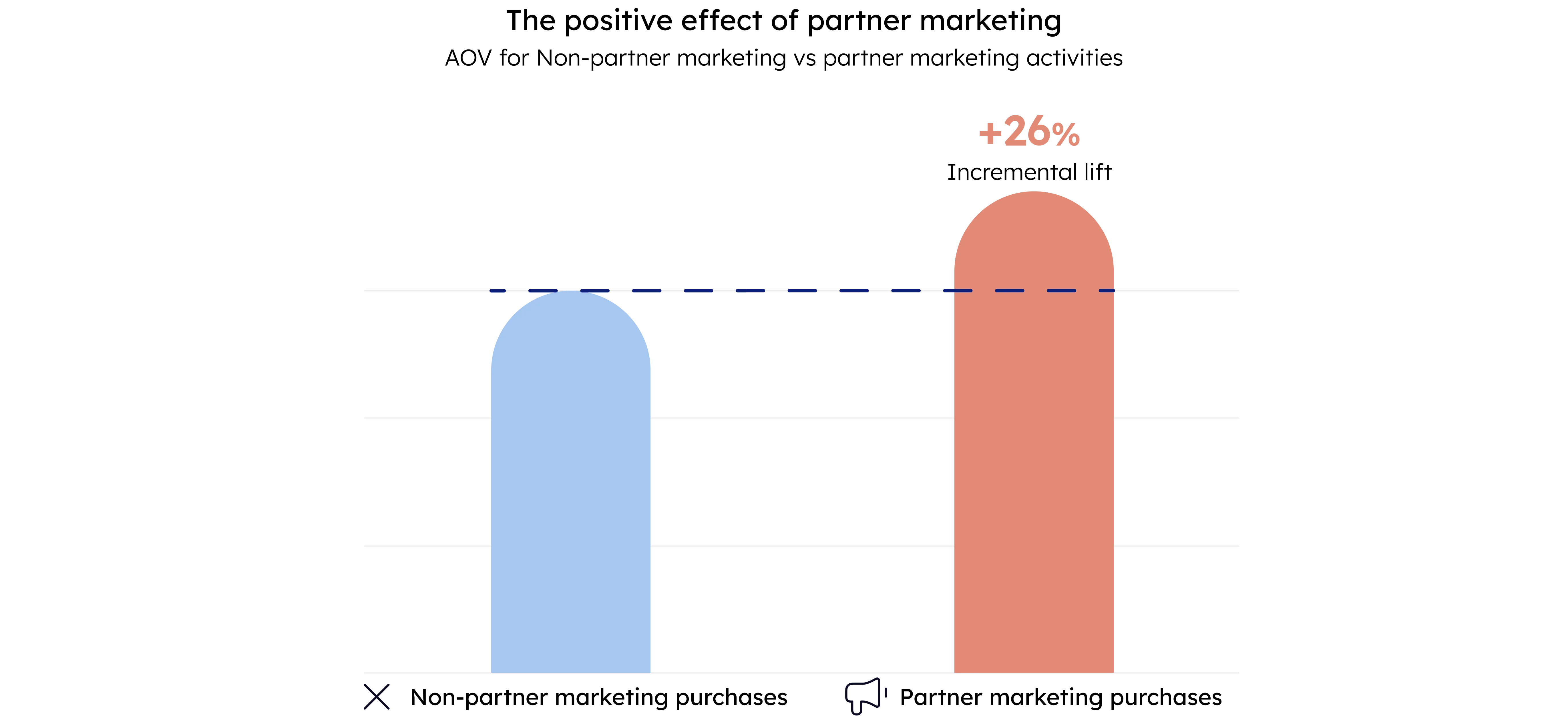

Partner marketing led to a 26% increase in average order value compared to other digital channels.

Category performance

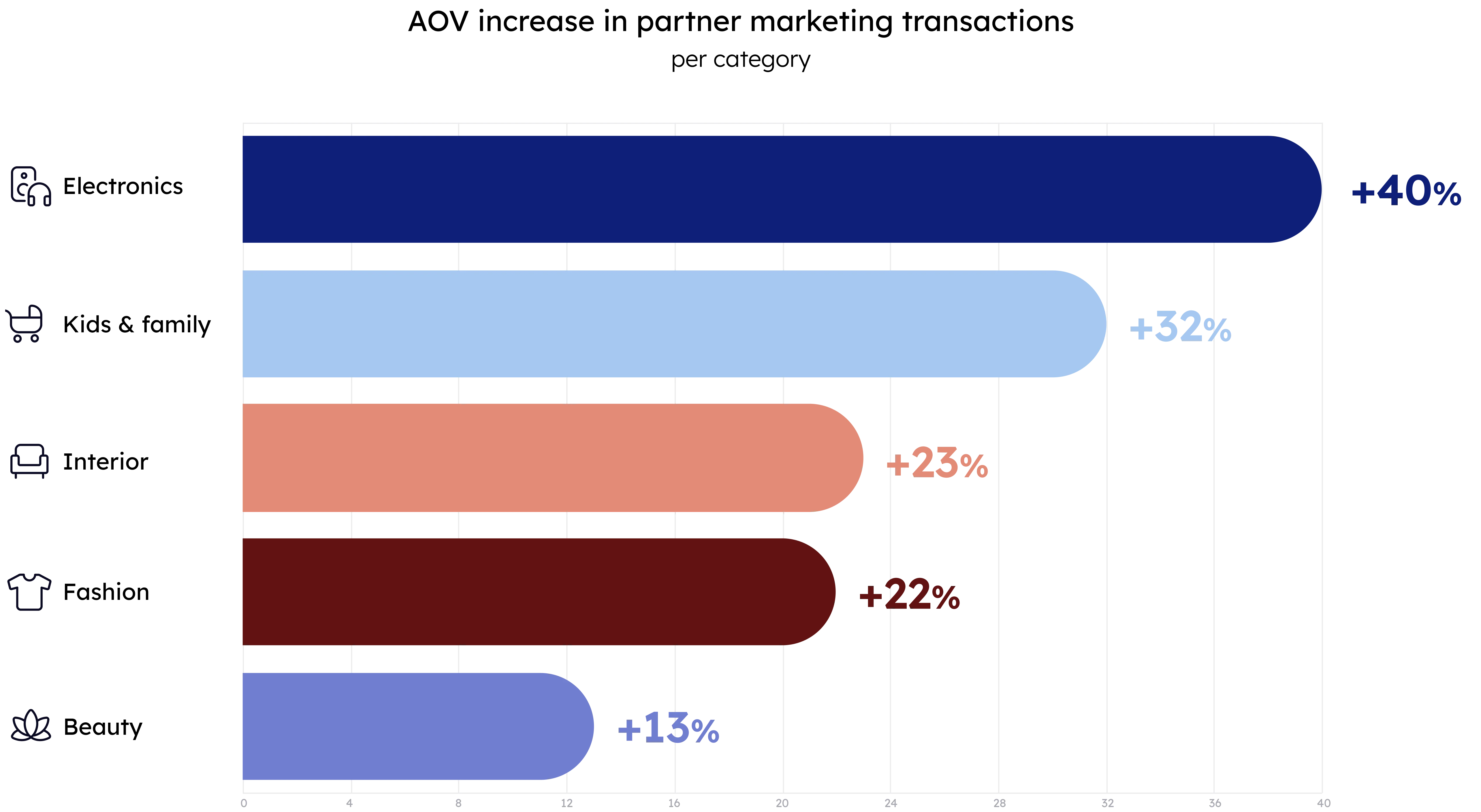

The highest increase in AOV was seen in Electronics (+40%) and Kids & Family (+32%).

Device performance

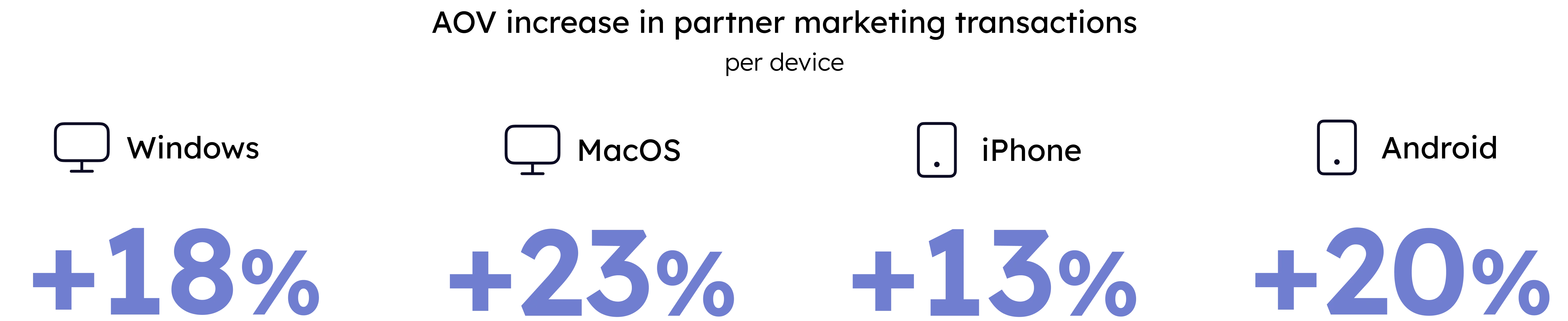

Partner marketing strongly increases AOV on purchases made both through mobile and desktop.

Incrementality and what it means

Incrementality means measuring the additional value a marketing channel adds. In this report, we’ve analysed data to answer one key question: does the partner marketing channel increase the average order value compared to other channels?

In this incrementality study, we compare the average order value (AOV) of sales coming through the partner marketing channel with sales from other digital channels. While this doesn’t directly answer whether a sale would have happened without the partner marketing channel, it helps indicate the unique value the channel might bring.

About the data

The report is based on data from a selection of brands connected to Adtraction’s partner marketing platform. The data is included in collaboration with the brands. The brands included are all well-known brands, operating in the largest e-commerce categories: Electronics, Kids & family, Fashion, Interior and Beauty.

Time frame

The analysed data comes from H1 2025, 1st of January to 30th of June.

Data points

Click data, site visit data, and verified e-commerce transactions.

Transaction volume

The study includes 9 352 909 tracked e-commerce transactions across participating brands.

Transaction groups

To evaluate the impact of partner marketing, all transactions were divided into two groups:

Partner marketing purchases: Transactions where the customer clicked a tracking link before completing the purchase.

Non-partner marketing purchases: Transactions completed without any interaction with a tracking link, driven by other channels or organic traffic.

By comparing order value and device usage between these two groups, we were able to evaluate the added value the partner marketing channel brings.

To ensure reliable comparisons, only brands with consistent tracking setups and sufficient volume across both groups were participating.

Controls

To ensure reliable results, we applied several controls to reduce bias and make the comparison between the partner marketing and non-partner marketing transactions as fair as possible.

To ensure accurate comparisons, the report includes brands with stable and complete tracking setups, allowing partner marketing activity to be reliably recorded. Participants were also required to have similar deduplication levels, comparable program terms, and sufficient transaction volume.

To evaluate the impact of partner marketing, we focused on AOV and device type.

Results

This study confirms that partner marketing delivers measurable incremental value. On average, partner marketing transactions had a 26% higher order value, than transactions originating from other digital marketing channels.

This demonstrates the channel's ability to deliver valuable transactions, higher than when the partner marketing channel is not involved.

This result confirms partner marketing’s role as a key growth channel, contributing to additional revenue, and higher-value transactions beyond what other channels generate.

Category level insights

When comparing AOV from the partner marketing channel vs. non-partner marketing channels, the increase varies across categories. The graph below provides an overview.

These results confirm that partner marketing impacts both expensive and everyday categories, creating measurable value across the full spectrum of e-commerce.

Device performance

The above findings with higher AOV from the partner marketing channel, are also reflected across devices.

Conclusion

The findings in this report highlight the strategic value of partner marketing in today’s e-commerce landscape. By reaching consumers through a variety of partners, brands are able to tap into new audiences and customer journeys that complement other marketing efforts.

The consistent increase in order value across both categories and devices suggests that partner marketing not only drives conversions but also influences purchasing behaviour in a valuable way. With strong tracking and a structured setup, the channel proves to be a scalable and cost-efficient contributor to growth.

Are you ready to get started?

Discover how Adtraction's performance-driven partner marketing can transform your business. Contact us today to find out more.

Feb 18 2026

Case

How smartphoto reached new customers across the Nordics with Adtraction Plus

With Adtraction Plus, smartphoto built brand-to-brand partnerships that helped them reach new audiences, reward existing customers, and grow across Sweden, Finland, and Norway.

Jan 29 2026

Insights

E-commerce Insight Report Q4 25

Check out our quarterly report with trends and insights from European e-commerce.

Jan 21 2026

Blog

What’s shaping partner marketing in 2026

In this post, we highlight the key trends shaping partner marketing in 2026 across our 12 markets.